The smart Trick of Estate Planning Attorney That Nobody is Discussing

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Blog Article

7 Simple Techniques For Estate Planning Attorney

Table of ContentsEstate Planning Attorney for DummiesLittle Known Questions About Estate Planning Attorney.Estate Planning Attorney - QuestionsThe Single Strategy To Use For Estate Planning Attorney

Estate planning is an action plan you can make use of to identify what occurs to your possessions and obligations while you live and after you die. A will, on the other hand, is a lawful paper that describes just how properties are distributed, who cares for children and family pets, and any type of other desires after you pass away.

Cases that are denied by the executor can be taken to court where a probate court will certainly have the final say as to whether or not the insurance claim is valid.

Some Known Incorrect Statements About Estate Planning Attorney

After the inventory of the estate has actually been taken, the worth of assets determined, and tax obligations and financial obligation settled, the administrator will then look for authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any inheritance tax that are pending will come due within 9 months of the day of death.

Each specific areas their assets in the trust and names someone apart from their spouse as the recipient. A-B counts on have actually become less popular as the inheritance tax exception works well for many estates. Grandparents may move properties to an entity, such as a 529 strategy, to sustain grandchildrens' education.

The Ultimate Guide To Estate Planning Attorney

Estate organizers can deal with websites the contributor in order to decrease gross income as an outcome of those contributions or formulate approaches that take full advantage of the result of those donations. This is an additional technique that can be made use of to limit fatality taxes. It includes a specific securing the existing worth, and thus tax obligation liability, of their residential or commercial property, while connecting the value of future growth of that funding to an additional individual. This approach includes cold the value of a possession at its worth on the day of transfer. Accordingly, the quantity of potential resources gain at death is likewise iced up, permitting the estate planner to estimate their prospective tax obligation liability upon death and much better strategy for the settlement of income tax obligations.

If sufficient insurance policy profits are available and the policies are correctly structured, any type of revenue tax on the considered personalities of properties adhering to the fatality of an individual can be paid without resorting to the sale of possessions. Profits from life insurance policy that are obtained by the recipients upon the death of the insured are usually revenue tax-free.

There are specific files you'll need as component of the estate planning process. Some of the most typical ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is just for high-net-worth individuals. That's not true. Estate planning is a device that everybody can utilize. Estate planning makes it much easier for people to identify their desires prior to and after they die. As opposed to what the majority of people think, it expands past what to do with properties and obligations.

The Basic Principles Of Estate Planning Attorney

You must start preparing for your estate as soon as you have any measurable asset base. It's an ongoing procedure: as life proceeds, your estate strategy ought to shift to match your situations, according to your new objectives. And keep at it. Refraining from doing your estate planning can cause undue financial worries to loved ones.

Estate planning is commonly taken a tool for the rich. Yet that isn't the situation. Learn More Here It can you could try these out be a valuable way for you to handle your possessions and obligations prior to and after you pass away. Estate preparation is additionally a terrific method for you to set out strategies for the treatment of your small kids and family pets and to detail your yearn for your funeral service and favored charities.

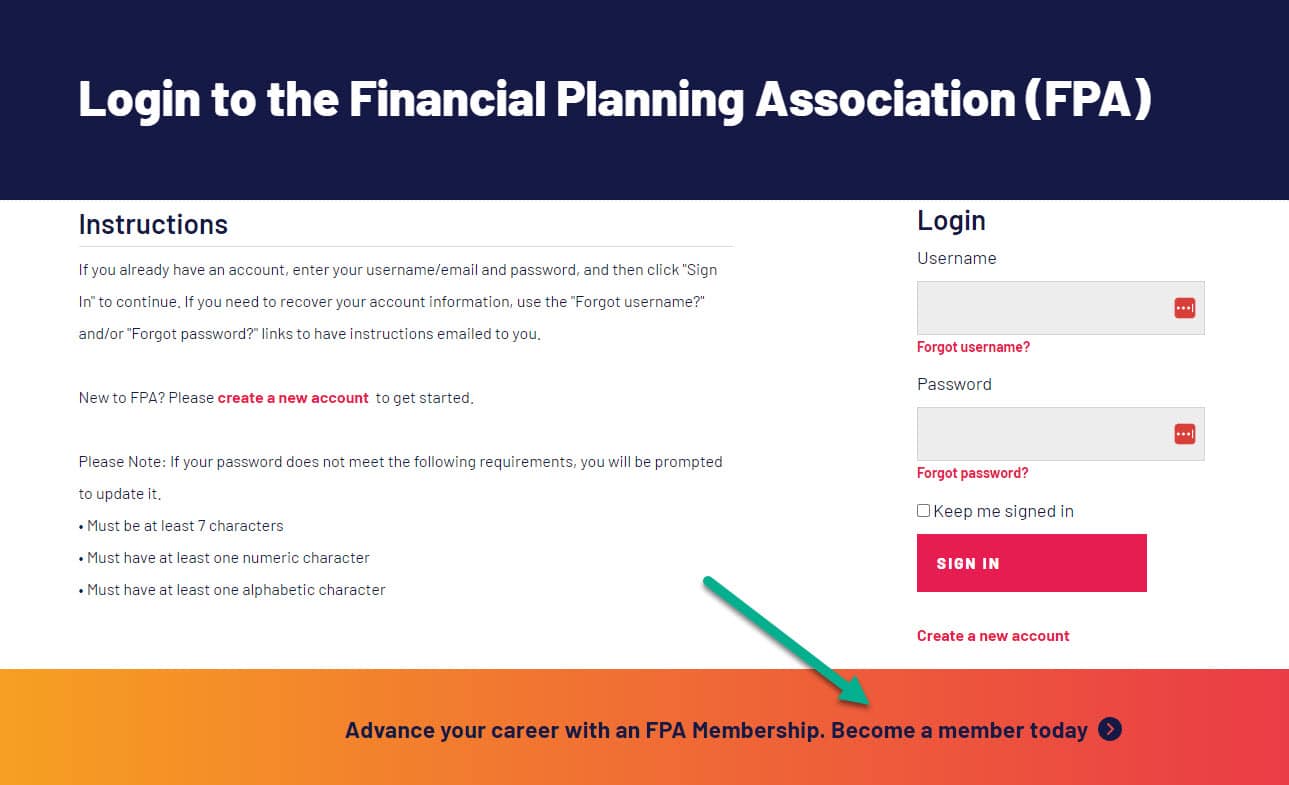

Applications must be. Qualified applicants who pass the examination will certainly be officially certified in August. If you're qualified to sit for the examination from a previous application, you might file the short application. According to the regulations, no qualification will last for a period longer than five years. Discover out when your recertification application is due.

Report this page